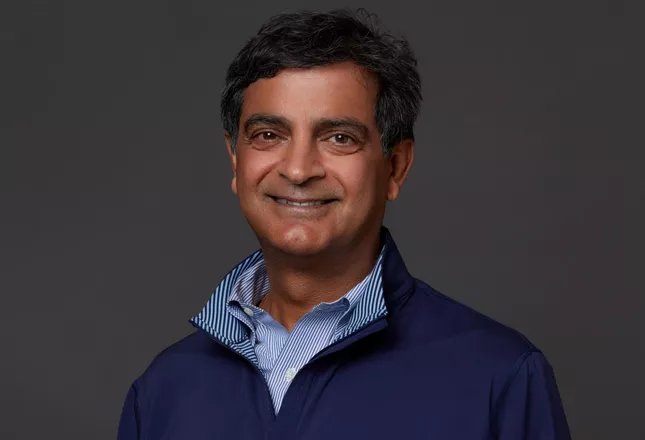

NEW YORK–WeWork Inc., a leading global flexible space provider, announced that Sandeep Mathrani will be stepping down as Chairman, CEO and as a director of WeWork effective May 26th.

Current WeWork Board member David Tolley has been appointed as interim CEO and will work alongside WeWork’s President and Chief Operating Officer Anthony Yazbeck. Lead Independent Director Daniel Hurwitz will now serve as Chairman of the Board and lead a special committee to search for a permanent CEO.

Since joining WeWork as CEO in February 2020, Mathrani has led the Company through a historic transformation. Under Mathrani’s leadership, in the face of a global pandemic and challenging macroeconomic environment, WeWork has made significant progress in cutting costs, growing revenue across all business segments and establishing additional lines of revenue through new products including WeWork All Access and WeWork Workplace, while also restructuring and strengthening its balance sheet, and optimizing its global real estate portfolio. Highlights of the company’s progress under Mathrani’s leadership include:

- Right-sized Cost Structure: Since Q4 2019 WeWork has eliminated over $2.3 billion of recurring costs, through reductions in SG&A, optimizing the global real estate portfolio and streamlining operating expenses.

- Sequential Revenue Growth: While navigating the global pandemic, the Company has consistently grown revenue – reaching $849 million in Q1 2023 from $593 million in Q2 2021.

- Restructured and Strengthened Balance Sheet: Through its recent debt restructuring the Company significantly deleveraged its capital structure by eliminating $1.2 billion in debt while also enhancing liquidity with over $1 billion in new funding and new and rolled capital commitments.

“It has been a privilege to lead WeWork during a notable transformation. Over the last three years we have restored the brand, grown revenue, right-sized the company, restructured our debt, and developed new product lines. I am grateful to have been able to lead such a resilient group of employees who through it all stepped up to meet and beat every challenge. I am firm in my belief that this is WeWork’s moment,” said Sandeep Mathrani, CEO and Chairman of WeWork. “Having worked with David Tolley over the last several months, I know that his financial acumen and leadership will keep WeWork moving forward as it continues to disrupt and lead the industry.”

“I am tremendously excited to join WeWork’s management team as the company continues to grow and progress towards free cash flow. I am also grateful to Sandeep for his work and insight to ensure this transition is seamless for our members, employees, and other stakeholders. Since joining the Board earlier this year, I have been impressed with the dedication and passion that the WeWork team brings to advancing our mission of empowering tomorrow’s world of work,” said David Tolley, incoming interim CEO and member of WeWork’s Board of Directors.

“We appreciate the tremendous work Sandeep has done for WeWork over the past three years. He successfully steered the company through the depths of the pandemic, introduced new revenue streams, and helped put WeWork on a path to profitability. We wish him all the best in his future endeavors. We are delighted that David will lead WeWork as interim CEO and will work with Daniel and the special committee to identify Sandeep’s permanent successor,” said Alex Clavel, CEO of SoftBank Group International.

“On behalf of the WeWork Board I want to thank Sandeep for his tireless and diligent efforts over the last three years. WeWork continues to move forward in all aspects of the business thanks to his vision, spirit and leadership,” said Daniel Hurwitz, Chairman of WeWork’s Board of Directors.

The Company also reaffirmed its second quarter guidance provided on May 9, 2023. As stated in the Company’s Q1 2023 earnings press release, WeWork expects its second quarter 2023 revenue to be between $840 million to $865 million and Adjusted EBITDA to be $(10 million) to $15 million. The Company expects its available cash and cash equivalents at the end of the second quarter to be consistent with or slightly better than projections provided with its debt restructuring transactions.