MUMBAI, India — Indian stock markets closed higher on Friday after the Reserve Bank of India cut the repo rate by 25 basis points to 5.25 per cent, with the Monetary Policy Committee led by Governor Sanjay Malhotra maintaining a neutral policy stance.

Along with the rate cut, the RBI sharply lowered its inflation forecast for FY26 to 2 per cent from 2.6 per cent and raised its growth projection to 7.3 per cent from the earlier estimate of 6.8 per cent.

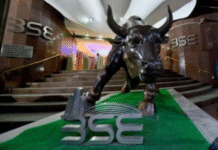

Following the policy announcement, the Sensex ended at 85,712.37, up 447.05 points or 0.52 per cent. The Nifty closed at 26,186.45, rising 152.7 points or 0.59 per cent. Analysts noted that the index finished near the 26,200 level, holding firmly above the 26,000 psychological mark.

Market watchers said strong support remains in the 26,000–26,100 band, which continues to serve as the immediate demand zone. They added that a sustained close above 26,300 is needed to unlock the next upside phase toward 26,450–26,600.

In the broader market, the Nifty MidCap index gained 0.49 per cent, while the Nifty SmallCap index slipped 0.57 per cent.

Most major sectoral indices finished in positive territory, with Nifty PSU Bank leading the gains with a 1.5 per cent rise. Banking, auto, IT, metal, realty, oil and gas, and chemical stocks also advanced, while media, pharma, consumer durables and FMCG indices ended lower.

On the Sensex, top gainers included State Bank of India, Bajaj Finserv, Maruti Suzuki, Bajaj Finance and HCL Tech. Hindustan Unilever, Eternal, Trent, Sun Pharma, Tata Motors PV and Bharat Electronics were among the leading losers.

Analysts said Indian markets responded enthusiastically to the RBI’s unexpected 25-basis-point rate cut — a move seen as unlikely given strong Q2 GDP data. They said the surprise decision, combined with sharply reduced inflation forecasts and supportive liquidity measures, helped spark a broad risk-on sentiment across equities. (Source: IANS)