New Delhi— Newly examined archival debates from early 19th-century Britain reveal that the defining objective of British foreign policy in India was not governance, reform, or even profit — but the urgent need to protect the British treasury from the massive debts accumulated in the subcontinent during the expansionist era of Governor-General Marquis Wellesley.

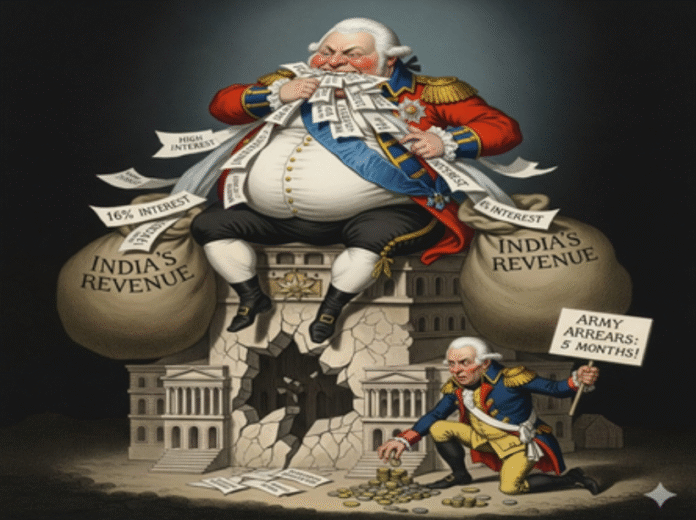

For millions across Hindustan in the early 1800s, the most destructive force was not war or rebellion but a mounting financial crisis created by Wellesley’s aggressive campaigns against the Mahratta Confederacy and the annexation of wealthy states like Oude. These conquests, celebrated in London as imperial triumphs, were in fact financed not by Company reserves but through high-interest loans raised within India — loans that caused the subcontinent’s debt to skyrocket from £11 million to over £31 million.

When the ballooning deficit finally rattled London, parliamentary debates in 1805–06 laid bare a startling truth: Britain’s foremost priority in India was to shield the British Exchequer from the consequences of its own empire. As veteran critic Mr. Francis bluntly declared, his new mission in Parliament was to “protect England not against the Company, but against India and its government,” arguing that the financial chaos unleashed in the colony would inevitably spread to the “mother country.”

Wellesley’s Extravagance and the Debt Spiral

The crisis was rooted in Wellesley’s “flagitious profusion,” as critics described it. His administration defied the East India Company’s chartered mandate of prudence and economy, replacing it with monarchical display and unchecked spending.

Among the examples cited in Parliament was the construction of the palatial Calcutta Government House — built for £220,000, a sum “unparalleled even among Eastern princes.” Wellesley was also accused of accepting £120,000 from local sources for his personal luxuries, despite explicit prohibitions.

Alongside costly wars, these expenditures devoured revenue from newly annexed territories. Many loans were nominally contracted at 10–12 percent interest, but British MPs noted that their real effective cost soared to 16 percent due to local financial mechanisms — a rate that turned India into what one speaker called “a vast engine of debt.”

Mr. Francis captured the cycle grimly: “Commerce produced factories, factories produced garrisons, garrisons produced armies, armies produced conquests, and conquests had brought us into our present situation.”

Cornwallis Confronts Financial Ruin

When Lord Cornwallis returned as Governor-General in 1805 to reverse Wellesley’s expansionism, he found India’s finances “in a deplorable state.” Army salaries were nearly five months in arrears; civil departments lagged even further.

Most draining was the enormous irregular force consuming £60,000 per month — troops Cornwallis quickly moved to disband, warning that their cost was more dangerous than any hostility they posed.

To prevent total administrative breakdown, Cornwallis resorted to extraordinary measures: he seized £250,000 in Company treasure destined for China, and instructed Madras to withhold £50,000 allotted for its own expenses. The diversion of China-trade funds, essential to the Company’s commercial survival, signaled just how close the colonial administration was to insolvency.

A Debt the Company Was Never Able to Pay

Compounding the crisis was the East India Company’s legal promise — made during its 1793 charter renewal — to pay £500,000 annually to the British government from its surplus profits. Despite this requirement, the Company “never paid any part” of the amount.

While long European wars could be cited as justification, Parliament found that exponentially rising Indian debt disproved any claim of prudent management. Instead of being a source of imperial revenue, India had become a financial sinkhole whose liabilities now threatened Britain itself.

Britain’s New Fear: India as a Financial Threat

This shift in perception marked a turning point. British policymakers, led by critics like Francis, reframed India not as a jewel of empire but as a potential contagion capable of destabilizing the British economy.

Francis warned Parliament that “evils originating in India will not confine themselves to that country,” arguing that ruinous conquests had consumed Britain’s troops and generated no revenue. He insisted that only a system of “jealousy, justice, and moderation” could prevent India’s financial collapse from engulfing London.

Castlereagh’s Solution: Move India’s Debt to Britain

To stabilize the colony while protecting British finances, Lord Castlereagh proposed a sweeping rescue: a massive, government-guaranteed loan to transfer India’s high-interest debt to lower-interest European markets.

The plan aimed to convert some £16–17 million of Indian debt — much of it contracted at double-digit interest — into British-backed securities, saving roughly £800,000 annually. That saving would, in turn, help secure the Company’s long-overdue annual payment to the British treasury.

Castlereagh assured Parliament that the loan would be backed by India’s territorial revenues and was no riskier than those raised for Ireland. Short of “absolute expulsion from India,” he argued, the revenue stream could not fail.

The Ultimate Subordination: India as a Permanent Mortgage

Historians note the irony that this solution did not alleviate India’s burden; instead, it institutionalized it. The subcontinent’s revenues were mortgaged indefinitely to secure British credit, while the country’s wealth continued to flow outward through a system of financial guarantees designed to shield London rather than rebuild India’s economy.

In the end, the parliamentary debates reveal that Britain’s “First Principle of Foreign Policy” in India was not reform, governance, or prosperity — but ensuring that the empire’s financial excesses never endangered the Exchequer. As the analysis notes, while conquests brought Britain glory, it was the bankers’ lien — guaranteed by India’s revenues — that endured. (Source: IANS)